This type of dependency credit is highly valued by families. It is in addition to the credit for child and dependent care expenses on Schedule 3 Form 1040 line 2 and the earned income credit on Form 1040 or.

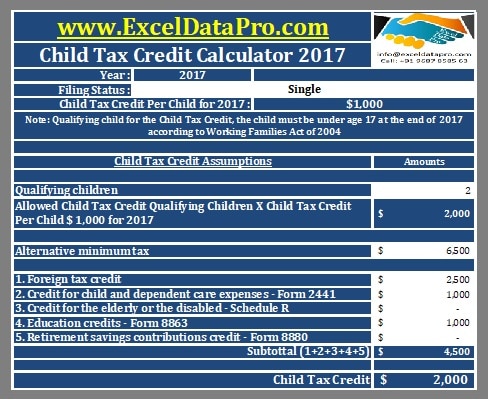

Download Child Tax Credit Calculator Excel Template Exceldatapro

You can save thousands every single year through claiming the child tax credit.

Child tax credit calculator 2020 irs. The child tax credit is a refundable tax credit of up to 3600 per qualifying child under 18. Phaseout Ends Single Head of Household Widower 15820. Kreditauszahlung in wenigen Tagen möglich.

The dependents tax credit calculator will enable you to figure out if you can claim your child as a dependent on your tax return and how much you can get. The Child and Dependent Care Tax Credit is worth anywhere from 20 to 35 of qualifying care expenses. Sehr gut Vergleichen morgen Geld auf dem Konto.

The maximum is 3000 for a single qualifying person or 6000 for two or more. Tax credits calculator - GOVUK. Maximum 2020 Credit Amount.

And in 2021 you may be able to get some of the child tax credit you are due sooner in the form of. This is a tax credit which means it reduces your tax bill dollar-for-dollar which makes it highly valuable for all families. The Child Tax Credit can be worth as much as 2000 per child for Tax Years 2018-2025.

Best-Zins-Garantie TÜV Note. The new system is part of the American Rescue Plan which. Number of dependents under age 17 at year end.

Earned Income Tax Credit for Tax Year 2020 No Children One Child Two Children Three or More Children. To be eligible to claim the child tax credit your child or dependent must first pass all of the eligibility. You will need to provide the number of children you have in two age brackets 5 and younger and 6 to 17.

You will claim the other half when you file your 2021 income tax return. Starting July 15 families will start receiving monthly payments as high as 300 per child as part of the new expanded child tax credit. The child credit is a credit that can reduce your Federal tax bill by up to 2000 for every qualifying child.

For Tax Years 2018-2025 the maximum refundable portion of the credit is 1400 equal to 15 of earned income above 2500. There are also maximum amounts you must consider. Anzeige Bis zu 2000 sparen mit dem günstigen Online Kredit in Deutschland.

8 Zeilen For parents of eligible children up to age 5 the IRS will pay up to 3600 for. Anzeige Flexible Raten fairer Zinssatz und schnelle Auszahlung. Include both Child Tax Credit qualifying children and other dependents.

Child Tax Credit CTC This credit is for individuals who claim a child as a dependent if the child meets additional conditions described later. The payments which could total as much as 300 for each child under age 6 and 250 for each one ages 6 to 17 will continue each month through December. To qualify for advance Child Tax Credit payments you and your spouse if you filed a joint return must have.

Your Adjusted Gross Income AGI determines how much you can claim back. 2020 Earned Income Amount. The IRS will pay half the total credit amount in advance monthly payments beginning July 15.

Kredit jetzt unverbindlich berechnen. The Refundable Portion of the Child Tax Credit. Under the new rules for year 2021 a taxpayer can receive the full 3000 or 3600 per child depending on the childs age.

Advanced Payment of the 2021 Child Tax Credit. The child tax credit for 2020 2021 allows you to get back up to 2000 per child in taxes. Just answer the questions and follow the steps.

The advanced Child Tax Credit Calculator will provide you with the estimated credit amount you can expect as your Child Tax Credit for 2021. These changes apply to tax year 2021 only. Calculate how much tax credit including working tax credits and child tax credits you could get every 4 weeks during this tax year 6 April 2020 to 5 April 2021.

X Total number of dependents on your tax return. In year 2020if taxpayers child tax credit exceeded the total tax liability for the year then law allowed only up to 1400 as a refund. The children ages are as of December 31 2021.

No income no problem. Our guide is going to introduce a child tax credit calculator you can rely on and show you exactly how much you can get from the IRS and how this tax credit works. You can calculate your credit here.

The IRS will send you a refund for up to this amount if any part of your credit is left over after eliminating your tax debt. Beginning with tax year 2018 and through 2025 up to 1400 of the 2000 Child Tax Credit can be refundable. Phaseout Begins Single Head of Household Widower 8790.

What is the Child Tax Credit. Filed a 2019 or 2020 tax return and claimed the Child Tax Credit on the. The other half of the credit can be.

The Child Tax Credit is intended to offset the many expenses of raising children. This refund is referred to as the Additional Child Tax Credit.

1040 2017 Internal Revenue Service Worksheets Educational Worksheets Budget Forms

The Turbotax Tax Refund Calculator Tax Refund Tax Refund Calculator Turbotax

8863 Form Https 8863form Freetaxfree Com Tax Refund Freetax Irs Irstax Wheresmyrefund Irs Taxes Income Tax Preparation Tax

National Tax Reports 2020 2021 Tax Refund Free Tax Filing Irs Tax Forms

Child Tax Credit Calculator Here S How Much You Re Getting Aug 13 Cnet

Download Child Tax Credit Calculator Excel Template Exceldatapro

Psa Didn T Get A Stimulus Payment You Might Need To Do This In 2021 Child Tax Credit Tax Debt Irs

Estimated Irs Tax Refund Schedule Dates Irs Taxes Tax Refund Irs

Child Tax Credit Calculator Check How Much Money Your Family Will Get Starting In July Cnet

Irs Child Tax Credit Payments Start July 15

What Is The Earned Income Tax Credit Credit Table Tax Credits Income Tax Income

Pin On Financial News And Info

Tax Refund Schedule Dates Tax Refund Irs Taxes Filing Taxes

Whoops Irs Supplemental Security Income Income Tax Return

Pin By Paul Lionetti On Quick Saves In 2021 Tax Forms Internal Revenue Service Fillable Forms

Tax Withholding Calculator For Employers Federal Income Tax Income Tax Calculator

Child Tax Credit Calculator How Much Will I Get

No comments:

Post a Comment